UMMC takes the fight to BCBS

Friday Pulse Check

Good morning everyone and happy Friday. This is the Friday Pulse Check.

In the news:

The US House to vote on the Inflation Reduction Act

Today, the House is expected to vote on and pass the Inflation Reduction Act. The name is mostly marketing as most economists have demonstrated that it will do basically nothing in the short-term (the next few years) to combat inflation. For us healthcare aficionados, the Act does include granting Medicare the ability to negotiate drug prices, but as we discussed on the FLATLINING Podcast last week, it amounts to ten to twenty drugs a year (out of the thousands) and Medicare can only begin doing that in 2025. The Act is mostly a marketing scheme for Democrats so they appear to have a legislative win before the 2022 midterms. Fortunately for them, pretty much everyone has stayed on point with their advertising plan (talking about how it’s going to save tons of money for seniors with the drug pricing, how much new green energy it is going to build, how much money it removes from the deficit). Just remember that $20 billion a year, when we’re speaking of the federal budget, equates to the amount of cash I still carry in my wallet (not much). Read more from the Washington Post.

New York surgeon’s No Surprises Act lawsuit tossed

I’ll admit, I did a double take when I saw this headline. We at Fulcrum Strategies generally think the No Surprises Act was a good law (a broken clock is right twice a day, right?). Apparently, one surgeon in Nassau, NY disagreed. He sued to have the law overturned because it “takes the physicians’ property without just compensation by prohibiting physicians from recovering the balance of the fair value of their services from their patients.” Well, that simply isn’t true. If a patient sees this surgeon at an in-network hospital and he is out-of-network, her insurance company will have to pay the surgeon at the in-network rate. If he doesn’t like it, he can take it to arbitration. Read more in Newsday.

The future of illicit drugs is synthetic

Jim Crotty, the vice-president of the Cohen Group and the former deputy chief of staff at the U.S. Drug Enforcement Administration, wrote in STAT this week about the possibility of synthetic alternatives to heroin, cocaine, and marijuana. He reports that the United Nations Office on Drugs and Crime has found more than 1,100 new psychosomatic drugs that were made to mimic more common illicit drugs. While none of these has the market share of a drug like fentanyl yet, he thinks it’s only a matter of time. Read more from STAT.

Q2 earnings, social media, and defamation. Oh my.

This week on the FLATLINING Podcast, Ron and I spent the hour discussing different payor headlines. Quarter 2 earnings were released in the previous weeks and we discussed these and the year-over-year numbers. Generally, the insurance carriers did well. The only group to post a real loss was Centene who, because of the age of its members, was hit harder by COVID-19. Additionally, Cigna reported a year-over-year loss, however last year’s revenue was inflated by the sell of one of their programs.

Here’s some live stock price data for the big carriers:

UnitedHealthcare: UNH 0.00%↑

Elevance Health (formerly Anthem): ELV 0.00%↑

Cigna: CI 0.00%↑

Humana: HUM 0.00%↑

Centene: CNC 0.00%↑

Note: Aetna is excluded from this list because its earnings fall under the retail giant, CVS Health. If you are viewing this newsletter in your email, the live stock prices are not visible; open this newsletter on Substack to view the live stock prices.

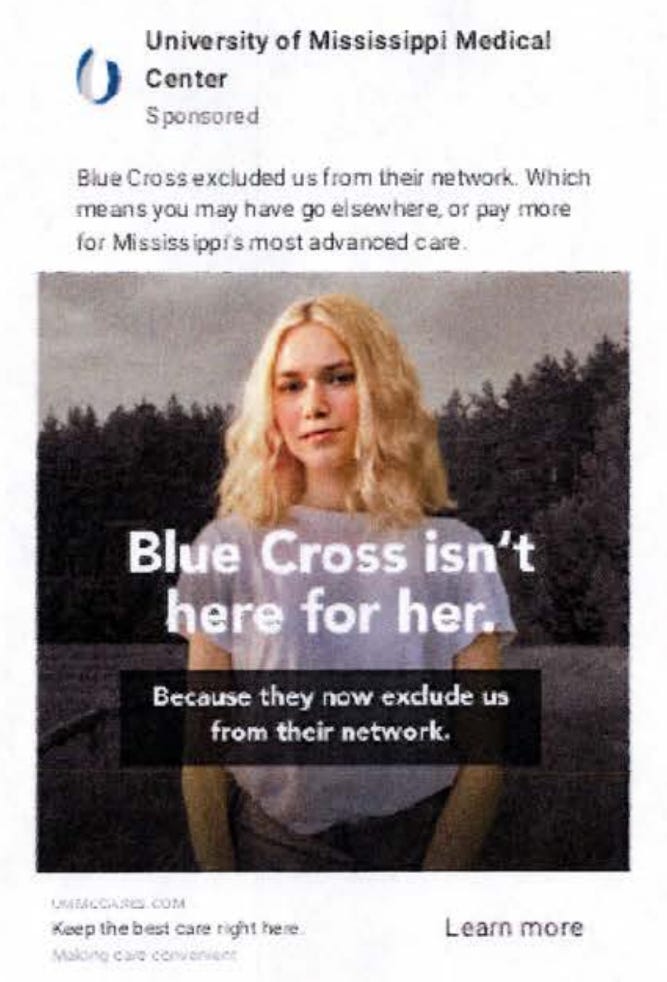

Ron and I also dived into the curious issue down in Mississippi where BlueCross BlueShield MS is suing several hospital executives for defamation. The University of Mississippi Medical Center and BCBSMS did the usual dosey-doe around the negotiating table and UMMC ended up terminating their agreement. We see (and sometimes recommend) that process to some of our clients.

What turned out differently was the hospital engaged in a nearly $300,000 advertising and social media campaign in an attempt to pressure BCBS to make an appropriate counter-offer.

You’ll notice in the image above, UMMC said that BCBS “exclude” its hospitals from its network. BCBS argues that this isn’t true because UMMC, not BCBS, terminated the contract.

To some in the media, that may seem like a “gotcha.” BCBS MS, however, covers over 50% of the population of Mississippi with their insurance. With that kind of monopoly (and the ability to dictate prices), UMMC could make a good argument that they were excluded.

Now, Ron doesn’t believe that this will end up in court because the contract will be settled before then. Plus, think about the amount of time it took for Johnny Depp and Alex Jones to get to trial. It is an interesting tactic from both the payor and the hospital and one we haven’t seen before.

Payors have many times out “messaged” physicians and hospitals when it is time to do negotiations. Check out this infographic from UnitedHealthcare in their dispute with WakeMed hospital in Raleigh, North Carolina:

Would WakeMed’s 20% increase in year one amount to that huge of price hikes for their customers? No, definitely not. Just look at the billions of dollars of profit UnitedHealthcare is bringing in just the last quarter alone. But it is a slick graphic.

In the case of UMMC and BCBS MS, the hospital is the one pushing back and it has really ticked off BCBS. Mississippi Today reported that BCBS has filed a subpoena request to see all communication between UMMC and two local news outlets.

For once, they were beaten at their own game. “Forced,” “excluded,” and “removed,” are all fair words to use when you’re dealing with an insurance company that has a monopoly in that state.

What is going on in Mississippi may seem like small potatoes to most people and it probably is. UnitedHealthcare is not watching Mississippi to determine what they do next with WakeMed. I do think someone else is watching with interest though: the drug companies.

As the House seeks to allow Medicare drug price “negotiation,” the pharmaceutical companies may be gearing up for what drugs could be coming to the table. I opened the podcast a few weeks ago by asking if something can really be a negotiation if one side is the federal government; another way of putting that is can something really be a negotiation when one side is your biggest purchaser.

Depending on what drugs Medicare wants to negotiate on (remember their only limited between ten and twenty), the drug companies have two options: take the price cut and jack up the prices of other drugs or say no.

More than likely, I believe they’ll take the first option. But if they take the second and certain groups of seniors are no longer able to access a drug through Medicare, don’t you think HHS will use similar language to UMMC?

“The drug companies were asking too much; they excluded seniors from getting this drug.” “They forced us to take this drug away from seniors.”

Now, big phrama won’t be able to sue the Secretary of Health and Human Services or pretty much anyone else involved, so they’d have to take it to the court of public opinion like everything else that happens in Washington. Can you imagine the political advertising from both sides?

Bottom line: I believe that BCBSMS is not happy that UMMC beat them to their own game; that is demonstrated by the subpoena requests. The question remains: will they continue with their lawsuit or will they quietly show back up to the negotiating table?

Let us know what you think in the comments below, email us at flatlining@substack.com, or tweet Matthew or Ron.

Subscribe to the FLATLINING Podcast on Apple Podcasts, Spotify, the iHeartRadio app, Amazon Music, Google Podcasts, and Audible.

Follow Matthew (@radioHandley) and Ron (@RonHowrigon) on Twitter.

Ukraine

As Russia continues to shell the largest nuclear power plant in Europe, international watchdogs are very concerned about the public health crisis that could happen if there is a radiation leak. UN Secretary-General Antonio Guterres demanded an immediate end to military activity near the plant, warning that it could “lead to disaster.” Read more from Deutsche Welle South Africa.

Final thought

Finally, here’s something new you might try over the weekend. A new study published in the journal Sports Medicine found that going for short walks after eating a meal may be good for your heart. “Light-intensity walking,” as the study’s authors call it, is capable of soaking up some of the excess glucose that’s swimming around your system after a meal. Read more from the New York Times.

With that, have a good weekend, and I’ll see you next Wednesday on the podcast.

Matthew