The No Surprises Act became the law of the land on January 1st of this year and with it has come confusion and spin from both the federal government and from large insurance companies. Here is a FLATLINING explainer on what the No Surprises Act does and does not do.

What is its purpose?

The No Surprises Act (NSA) law was passed by Congress in December 2020 and it was designed to do three things. Firstly, it was created to protect patients from balance billing when they saw an out of network doctor at an in-network hospital. Balance billing is the practice where a patient would receive a bill from a physician or specialist for services not covered by insurance.

Because the out of network doctor could no longer directly bill the patient, he or she would have to work directly with the patient’s insurance company to receive compensation. This is the basis for the second intent of the NSA. It was designed to create a fair and comprehensive process to make sure that doctors were paid fairly for the services they provided. Congress created the Independent Dispute Resolution (IDR) process. In the IDR process, both the doctor and the insurance provider could bring evidence demonstrating why they each thought a service was worth a certain amount. It was designed to make sure that the insurance companies did not control final payment rates and that arbitrary or artificial standers were not created.

Thirdly, Congress’ intent was to incentivize insurance companies and doctors to enter into more agreements with one another. This way, the need for the IDR process would lessen overtime.

Was the law implemented as intended?

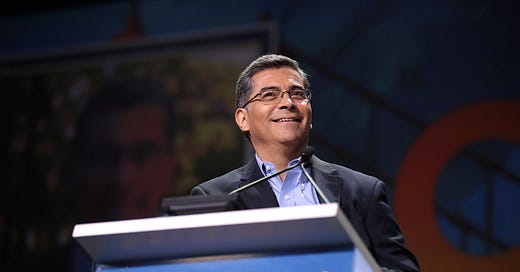

In September 2020, Department of Health and Human Services Secretary Xavier Becerra introduced an Interim Final Rule that effectively changed the way the NSA would be implemented and how it would work. Mr. Becerra’s rule protects insurance companies from many different types of evidence that doctors can use to justify the costs of their services. This creates an unfair advantage for the insurance companies and allows them to effectively dictate how much they will pay for a service.

Additionally, this has created an incentive for insurance companies to terminate their contracts with in-network doctors and specialists that they deem cost too much. BlueCross BlueShield of North Carolina has sent letters threatening termination to over fifty hospital-based groups if they do not agree to a reduction of rates.

The Interim Final Rule has effectively eliminated two of the original goals of the NSA. In short, the law has not been implemented as it was originally intended.

What has been the reaction to the Interim Final Rule and BlueCross BlueShield’s letters?

A number of groups, last year, filed a lawsuit against the Department of Health and Human Services demanding that Interim Final Rule be rescinded because it effectively creates new law. A federal court has not yet ruled on the suit.

Bipartisan members of Congress, last year, also sent a joint letter to Mr. Becerra, expressing that the Interim Final Rule does not represent the law they passed in 2020.

The American Society of Anesthesiologists claimed in November 2021 that BlueCross BlueShield of North Carolina was abusing the NSA in order to improve their bottom line. “Insurance companies are threatening the ability of anesthesiologists to fully staff hospitals and other healthcare facilities. Left unchecked, actions like these of BlueCross BlueShield of North Carolina will ultimately compromise timely access to care for patients across the country.”

What does this mean for my healthcare?

If the actions that BlueCross BlueShield of North Carolina are repeated by other insurance companies, it could have serious consequences for a patient’s healthcare. Unilateral reductions will effectively serve as a budget cut to physician groups who will then have to cut the services they provide.

Many hospital-based groups work at more than one hospital. In many cases, the revenue from urban hospitals helps subsidize the lack of income from rural hospitals. Large reductions in reimbursement from insurance companies at the more urban hospitals could mean that many of these groups will be forced to leave rural hospitals. This could mean that rural hospitals across the country will be without emergency coverage, radiology, or anesthesia. Many rural hospitals already struggle financially and will not be able to provide subsidies to provider groups who are handed a rate reduction from insurance companies without having to cut nursing staff or other areas that will negatively impact patient care.

The staffing cuts do not just apply to the hospital but to the physician groups as well. A facility that is currently staffed with two doctors and two physicians may be reduced to one of each. This means if a patient enters the emergency room for a car crash and another patient enters suffering from a heart attack, it is likely that one of those patients will not survive. This same example is true for radiology and anesthesia. Both specialties are frequently called on in emergency situations but may not be available if a provider group is forced to cut its staff. Radiologists are necessary to read a CT scan for a stroke patient and if one is not available, it could have disastrous consequences for the patient. Insufficient access to Anesthesia can delay lifesaving surgeries in emergency situations.

Is it true that emergency medicine drives up the cost of healthcare?

This is the argument that BlueCross BlueShield of North Carolina has made in defense of demanding rate cuts for hospital-based groups. This defense simply has no basis in fact. Emergency medicine, radiologists, and anesthesia do not rank in the top five of the highest paid specialty groups. Cigna, Anthem, and United Healthcare, however, have seen their stock prices climb an average of 49% since 2019. Insurance companies can lower the cost of healthcare without reducing the quality of the care, but have chosen instead to limit access and quality of care.

The No Surprises Act was intended to protect patients from balance billing. Under Mr. Becerra’s Interim Final Rule, it does. Because of the way it protects insurance companies, however, it could seriously impact quality and access to care.